Market stock

Since its inception over 10 years ago, the impact bond market, which consists of green, social, sustainability, and sustainability linked bonds (SLBs), has grown substantially. Initially, the only issuers were large supranational and multi-lateral development banks, but fast-forward to the present day and the market consists of many different sectors, currencies, and countries, at all points across the main yield curves. As at the end of November 2022 over US$3.7bn of labelled impact bonds have been issued, with over US$3bn outstanding[1]. The diversity of the impact bond market now resembles that of the wider global bond market.

Market trends

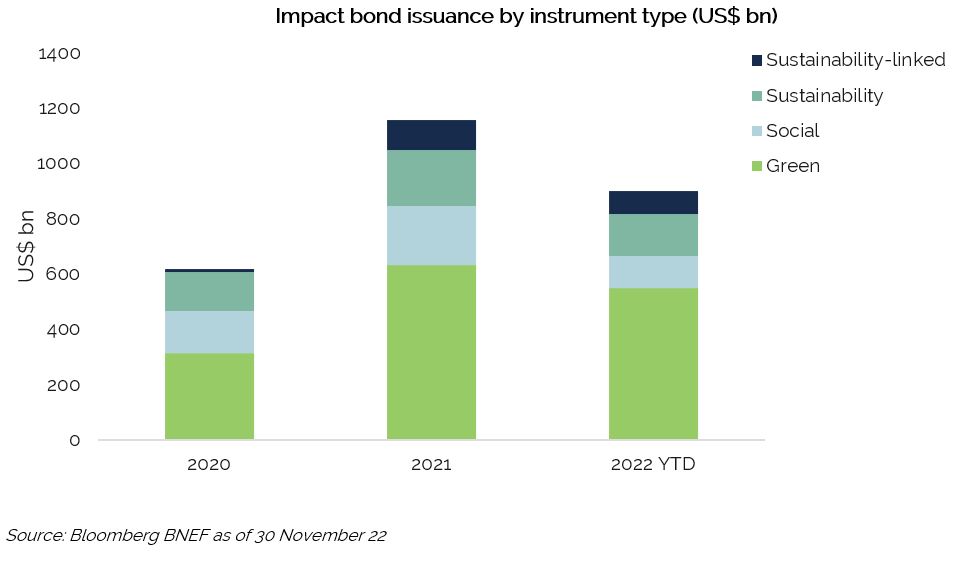

Turbulence in global capital markets in 2022 has slowed the pace of new issue debt volumes during the year, compared with 2021 [1] . According to a recent Moody’s report, global bond issuance contracted by 27% in the first 9 months of 2022 compared to the same period in 2021[2], reflecting the greater caution by borrowers and investors alike amidst heightened macroeconomic and geopolitical uncertainties. During the same timeframe, the labelled bond market also saw a fall in new issue volumes, but the reduction has been more moderate, at a 17% decline [1] . Labelled bonds have therefore increased as a proportion of the overall bond market, testament to the ongoing structural shift in investor demand and borrower supply to serve sustainable environmental and social priorities. The labelled bond market grew at a record pace in 2021, and 2022 has continued to see robust issuance volumes, while remaining well ahead of the 2020 pace, which was itself a new record that year.

Evolving trends in the market

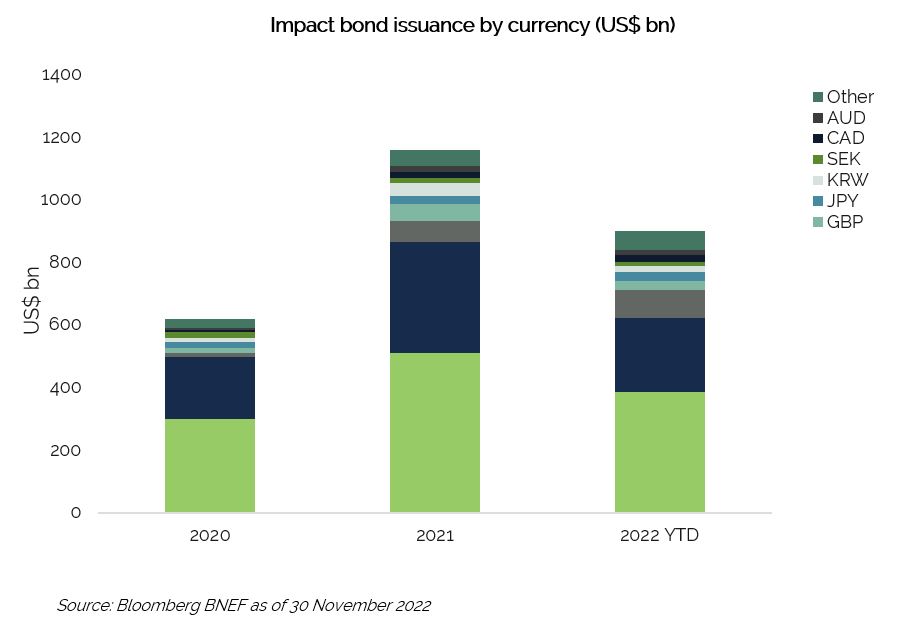

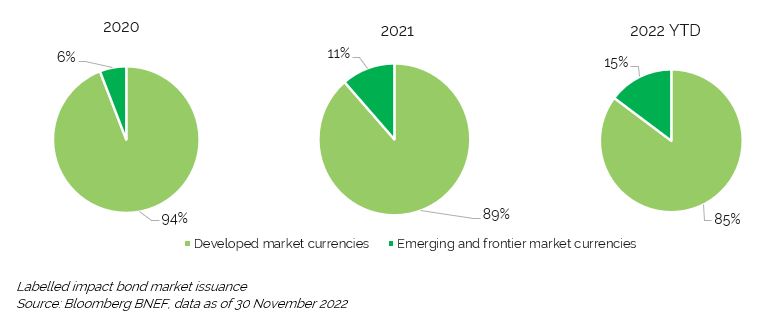

Euro and US dollar denominated issuance continues to be the dominant source of new supply for the impact bond market. That said, the labelled bond market continues to diversify across a number of other currencies of denomination, most notably Chinese Renminbi (CNY). CNY now has the third largest stock outstanding, with new issuance having increased from US$68.4bn in 2021 to US$88.7bn year to date in 2022 [1] . It is an encouraging sign that the labelled bond format is being adopted more broadly across the globe. There was debut issuance in Ugandan shilling and Tanzanian shilling in 2022, from the African Development Bank and NMB Bank respectively, reflecting the reach of the labelled bond universe. To date, there has been issuance from over 80 countries in a total of 50 different currencies1.

The volume of social bond issuance has fallen this year, due in large part to a reduction of COVID related social bond issuance as we move beyond the pandemic. Despite this, overall labelled bond issuance still sits 50% higher than during the same period in 2020 [1] .

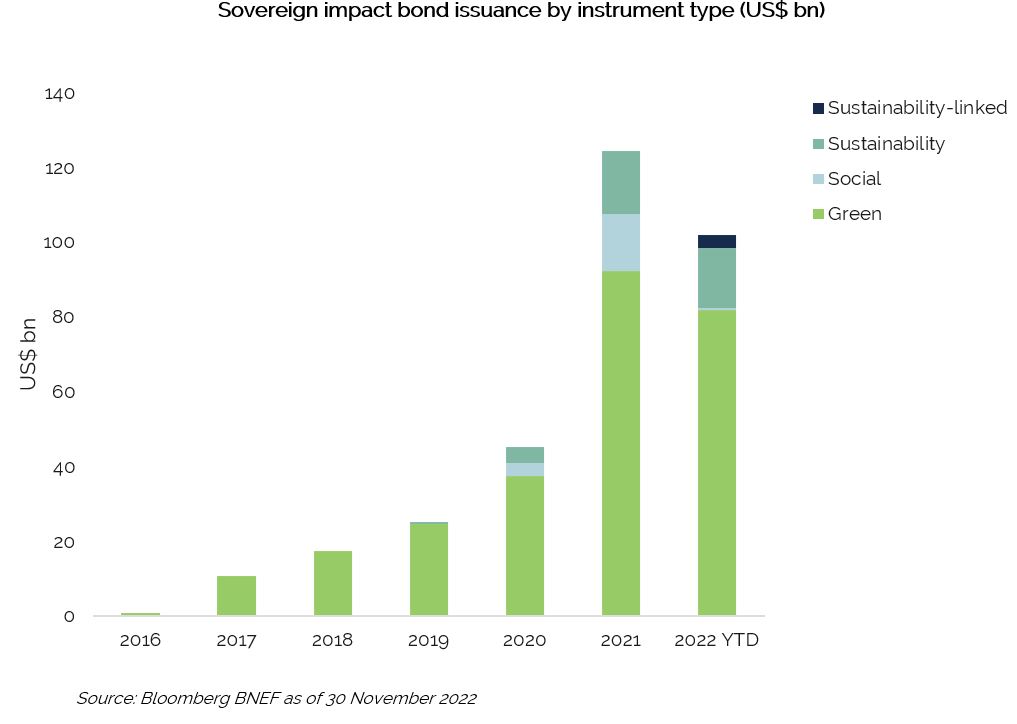

There has been a surge in sovereign labelled issuance in recent years, most notably since 2019. This trend has continued with 2020 issuance almost double that of the previous year, and 2021 almost five times as high as the 2019 figure [1] . We have continued to see more sovereigns issuing impact bonds this year, with approximately half being an inaugural issue. Sovereign bonds issued in major currencies received the strongest interest as well as high levels of oversubscription. This year, the French Government issued the first inflation linked green bond and Austria issued the first green T-bill, in a sign that governments are willing to add different instruments to the financial toolkit that they use to produce a positive impact. As the world recovers from the global pandemic and faces threats to energy security, there is recognition that a transition to a low carbon economy is critical, and that green, social, and sustainability bonds will be an important funding vehicle to finance the transition. Recent IPCC reports on the state of the global climate as well as the latest COP 27 conference have brought a greater spotlight to the immediate action that is required to combat an increase in global temperatures.

In a positive sign for the growth of the labelled market, more than 500 corporates issued an impact bond for the first time in 2022 [1] . While the corporate segment of the labelled market has been historically dominated by financials and utilities, there has been increased diversification beyond these two sub-sectors into industrials, communications, and other types of corporate issuers. In the labelled bond universe, all high-level sectors have been represented for some time, and the majority of sub-sectors have followed this trend. One new sub-sector, design, manufacturing and distribution, was included this year after the issuance of a 5-year green bond by the US technology company, Jabil [1] .

One major indicator of progress has been the rise of the number of inaugural green and sustainability bonds issued by auto manufacturers. As a high-profile producer of carbon emissions, auto companies have recognised the responsibility they have towards becoming carbon neutral. Despite these entities having been impeded by significant supply chain issues and a lack of new sales, Volvo, Toyota, and Volkswagen have all issued impact bonds this year, with the use of proceeds going towards electric vehicle manufacturing and infrastructure related projects [1] .

Green bonds were also issued from other hard-to-abate sectors, including shipping. Danish shipping company Maersk made its debut issue with a framework focusing on two use of proceeds categories. The first is focused on clean transportation: the acquisition or retrofits of dual fuel container vessels designed to run on green methanol, investments in procurement of green methanol and investments in low carbon land-based transport and infrastructure (both electric and green hydrogen powered). The other category focused on green buildings, such as new energy efficient logistics centres or retrofits to existing centres. The first bond issue is solely focused on clean transportation.

Copenhagen, Denmark – A.P. Moller – Maersk (Maersk) announces that it has ordered a further six large ocean-going vessels that can sail on green methanol, bringing the total number on order to 19[3].

Emerging market labelled issuance has also increased this year. As of the end of November, there has been a 12% increase relative to the same period in 2021, which itself was a 260% increase from the previous year [1] . This is predominantly due to an increase in Chinese renminbi and Korean won denominated issuance. In these markets, we are seeing a wide range of entities issuing bonds with varying maturities and ratings. There is a greater proportion of sub-investment grade issuance, and some further progress to be made in raising awareness of the standards of transparency, disclosure and reporting that investors need.

A broadening market is enabling easier and more effective portfolio management against mainstream benchmarks. It also allows the creation of more specific strategies focusing on different regions, sectors, and currencies, in turn allowing a greater allocation of capital towards impact bonds.

SLBs have remained a relatively small segment of the labelled bond market, although this has grown quickly since the first issue in 2018. As issuers commit to greater scrutiny and higher standards, we are of the opinion that SLBs in their current form are likely to be crowded out by the higher standards of labelled bonds demanded by investors.

At AIM, verification is the first step of our investment process. Our verification process, termed SPECTRUM, includes both sustainability and credit assessments. Our SPECTRUM process is one of positive selection to identify and screen both bond issues and issuers for meaningful and measurable impact. We invest only in bonds that fulfil our stringent criteria. These include credit worthiness of the issuer, environmental/social benefits, and the ability to determine that proceeds are dedicated to positive impact. Our verification process is applied to both labelled and unlabelled green, social, and sustainable bonds. The output of this process is our SPECTRUM universe, from which the portfolio management team build and manage the portfolios. Our current set of funds and portfolios have a focus on use of proceeds impact bonds, as opposed to general corporate purpose bonds, and therefore none of the SLBs that have been issued have met our verification criteria.

Liquidity

Market liquidity has been more challenging than last year. This is not unique to labelled bonds but reflects the volatility caused by the rising rate environment and the uncertain and frequently changing macroeconomic outlook.

Greenium

As the market has grown, so has focus on the ‘greenium’. Early last year, we released a piece which surveyed various pieces of research, identifying the key arguments and data for and against the greenium, along with an acknowledgment of the weaknesses surrounding the methodologies involved in the research[1]. Also in this piece is a discussion surrounding the evidence suggesting that green bonds exhibit stronger secondary market performance and lower volatility relative to their non-green peers,

Our fundamental conclusion remains that pockets of temporary greenium can be attributed mainly to supply and demand mechanics. The most commonly referenced evidence of the greenium is the German twin government bonds; the green part has historically traded at a slightly lower yield than its conventional counterpart. However, while they are identical in other ways, the original green bond is less than a third the size of its twin.

As the market grows and the opportunity set increases, we would not expect to see any sustainable greenium in sectors and currencies where there are plenty of options to choose from, such as euro denominated bonds and issuers who have issued many green bonds across their curve.

This year, we have seen some of those expectations play out in the market, in so far as the level of greenium seen in the primary and secondary market has fluctuated depending on currency, duration, sector, country, and size.

At AIM our portfolios are fully invested. We consider valuation discipline important in the choice of primary and secondary market issues. We do not take the existence or absence of any “greenium” into account in our process. We focus on the quality and outlook of the bonds we buy, and valuation against peers and the market.

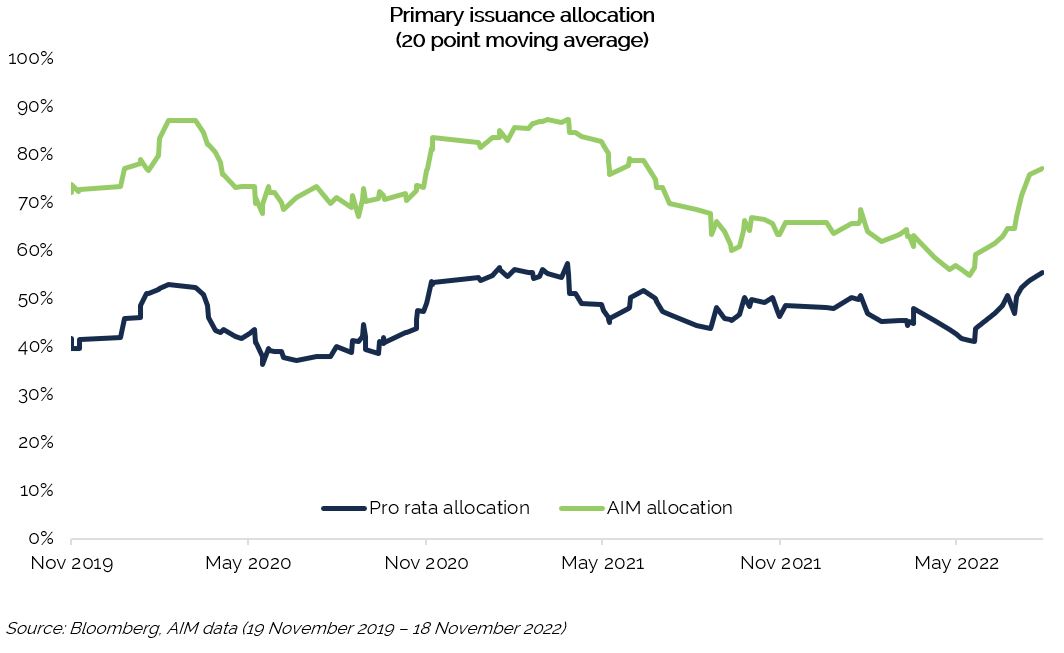

As part of our SPECTRUM process, we continually engage with issuers and brokers, enabling us to maintain close relationships and share knowledge and expertise as a leading investor in the impact space. Engagement over time is valuable to issuers too. This is regularly reflected in above pro-rata allocations of labelled primary issues to leading dedicated impact investors such as AIM. For highly selective funds like ours, good allocations are helpful for efficient portfolio management. The graph below depicts this trend, based on internal data recorded over the past three years.

Regulation

There has been a noticeable increase in the scrutiny of regulators on funds labelling themselves as green, sustainable or ESG, as well as the individual investment processes. Regulators have been investigating potential greenwashing at multiple high profile entities, recently culminating in fines for some major institutions. Greater regulatory inspection of the analysis that goes into the investable universe of ‘sustainable’ funds has further emphasised the importance of the rigour that supports our own SPECTRUM process. The detailed verification assessment, along with the measurement and reporting of the true impact of each security that our portfolios invest in, is critical for us to achieve a positive impact whilst generating mainstream financial returns.

The introduction of the EU Sustainable Finance Disclosure Regulation (SFDR) last year has been another factor influencing financial market participants regarding sustainability claims made, evidencing impact, and transparency of financial products. At AIM, all our European funds are labelled Article 9, the highest sustainability classification. While we have only labelled Article 9 the funds that the SFDR regulation applies to, all our strategies are managed with the same sustainability standards, utilise the same investment process, methodologies, and generate environmental and social impact.

In Japan, the Financial Services Agency (JFSA) established its Expert Panel on Sustainable Finance at the end of 2020. Following this, the JFSA published ‘Strategic Priorities July 2022-June 2023’. This includes encouraging disclosure based on the Task Force on Climate-Related Financial Disclosures (TCFD) recommendations. The JFSA has also compiled the Code of Conduct for ESG Evaluation and Data Providers while the Financial Accounting Standards Foundation (FASF) established the Sustainability Standards Board of Japan (SSBJ) that will consider specific disclosure contents based on the International Sustainability Standards Board’s climate-related disclosure standards.

The UK is also working on Sustainability Disclosure Requirements (SDR) and a UK Taxonomy. In Australia, the Australian Prudential Regulatory Authority (APRA) and the Australian Securities and Investment Commission (ASIC) are increasingly encouraging better disclosure of climate related-risks and have released a guide on climate change financial risks. APRA will gauge the alignment between this guidance and TCFD recommendation.

We are pleased to see regulation developing in this space, as we believe it will help to improve the integrity and impact of the labelled bond market and the funds that use it. However, we do also see a risk of some unintended negative outcomes resulting from the development of regulation and hope that regulators will gather feedback and be willing be make amendments where necessary as it becomes common practice to implement the emerging reporting and disclosure frameworks.

Outlook

Despite weaker and more volatile bond markets in 2022, resilience of the size of the labelled impact bond market is plain to see. The growing number of sovereign issues and increased regulation will further enhance the credibility and scope of impact bonds and will continue to ensure effective and transparent impact of the various projects funded. Going forward, we expect to see issuance in more emerging and frontier markets, as well as a greater amount of sub investment grade issuance.

Going beyond traditional impact bonds, the rise of transition finance is another trend we see gaining traction in 2023 and beyond. Operating in parallel to the use of proceeds bond market, this type of finance will identify those entities that are leading the transition to a low carbon economy and would allow investment in their general purpose bonds. There is a recognition that even the most highly polluting industries, such as steelmaking, cement and shipping, will need assistance to move towards a net zero future. Transition finance will aim to identify and invest in those with measurable and actionable targets and strategies. According to McKinsey, reaching net-zero GHG emissions by 2050 would require on average around US$9.2tn worth of investment per year[1]. As such, spending will need to increase substantially in order to mitigate a temperature rise above 1.5ºC. This type of fixed income investment would unlock the entire debt profile of an issuer, rather than individual SLBs or “transition” labelled bonds with a specific use of proceeds, which have all been introduced into the market as separate structures over recent years.

In our view, the impact bond

market is here to stay. As interest rates normalise, inflation slows, and the

macroeconomic outlook stabilises, we expect to see a continued increase in the

proportion of labelled bond issuance relative to the overall market in 2023 and

beyond. The long-term growth trajectory of the impact bond market is unlikely

to be derailed, even by future exogenous shocks, as governments around the

world recognise the role that public and private debt markets will need to play

as we enter the next stage in the battle against the climate crisis.

[1] Bloomberg BNEF data as of 30 November 22

[2] Moodys report press release

[3] A.P. Moller-Maersk continues green transformation with six additional large container vessels

[4] Greenium – fact or fiction?

[5] McKinsey: The net-zero transition: What it would cost, what it could bring