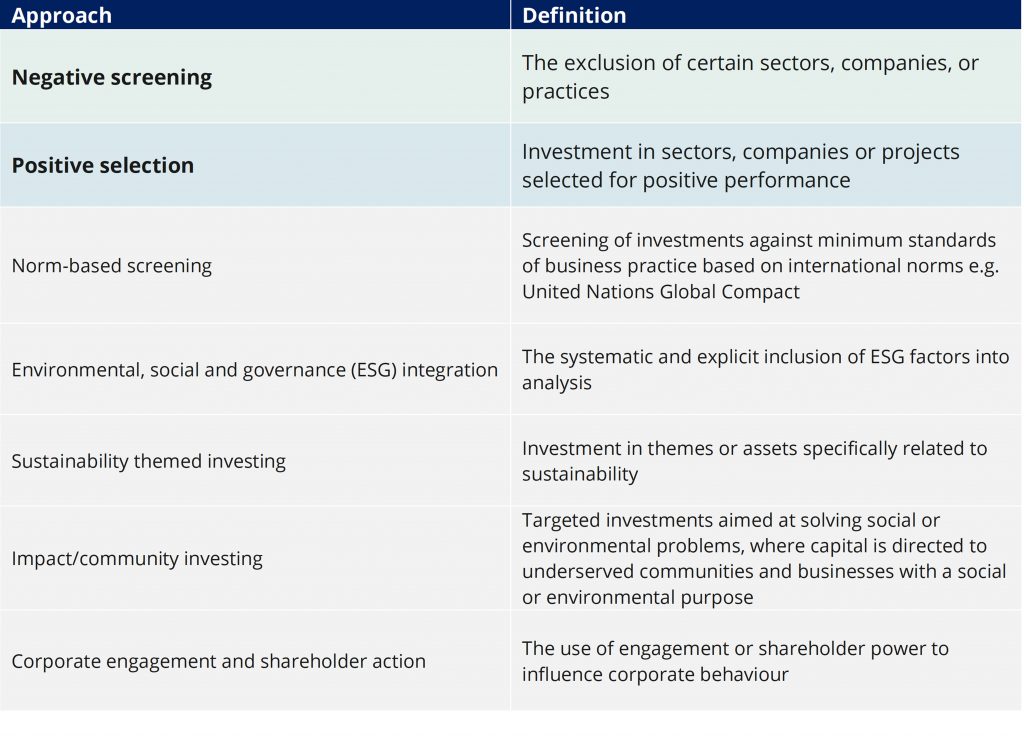

As the impact and sustainable investing markets expand and develop, different investors are employing different investment selection strategies. The Global Sustainable Investment Alliance provides a helpful characterisation of these different approaches[1]. Those approaches to investment selection do not have to be applied in isolation from each other. Here we compare two; positive selection and negative screening.

At AIM, we use our proprietary SPECTRUM Bond® analysis to assess the impact of issuers and issues. SPECTRUM is predominantly a positive selection methodology, but it also incorporates elements of the other approaches detailed below.

Global Sustainable Investment Alliance, ‘2018 Global Sustainable Investment Review’, pg.7

Negative screening relies on exclusionary criteria and filters. Thresholds are applied based on various data points, and organisations are assessed for compliance with the exclusionary screens. Organisations breaching any screens are excluded from the investment universe. It is a passive screen based on historical data, that is only as good as when last updated.

What is positive selection?

Positive selection for impact investment involves a detailed assessment of a potential investment in order to understand its environmental, social and governance performance and the impacts—desired and undesired; direct and indirect—that could be associated with that investment. It requires detailed research and engagement with the organisation under assessment. It is an active, forward-looking approach and is judgement based.

Negative screening allows an investor to robustly apply chosen ethical views across holdings without subjectivity, but it also removes the context specific, judgement-based element of the research. It filters out unsavoury activities, but it does not go further by selecting investments that are likely to have positive impacts. Negative screening is a relatively quick check and can be automated depending on access to third party data. However, it is based on a point in time dependent on the data available. At best it reflects up-to-date data, but it is not a forward-looking tool. The result of negative screening is a binary outcome, entities are either included or excluded. Negative screening tends to apply the same thresholds across all investments. This can be both a pro and a con. It results in consistency across all issuers/issues assessed. However, a consistent screening threshold is not always the best approach to take. It removes the ability to make a judgment-based context specific decision about the most effective assessment tools to employ. Negative Screening requires a strong data set with good availability or disclosure of KPIs across the opportunity set. A challenge for a varied market like the impact bond universe.

Positive selection for impact investments ensures that all investments meet the highest standards and generate measurable, positive social and environmental impacts. It allows a context specific approach to be taken and promotes detailed research, giving a better understanding of the issuer from an intended impact and externality point of view. The analyst must take a multi-layered approach, as it requires research on specific parts of an organisation and a review of the organisation from a holistic point of view. Positive selection lets the analyst assess based on current performance and direction of travel, i.e. transition strategy. Engagement with the issuer often forms a useful part of this research, allowing relationships to build. This also creates accountability between the investor and the issuer as goals and milestones will be discussed. It is a nimble approach, meaning that assessments can incorporate evolutions in the market, sector knowledge, and technology as they happen. Positive selection allows judgement to be made based on the direction an organisation is travelling in, whereas negative screening assigns a judgement based on past performance. It is a more time-consuming process that requires deep expertise, but the result is a detailed understanding of the investment. The outcome of positive selection allows entities researched to be placed on a performance scale.

Example: Ørsted

Ørsted was once one of the most coal-intensive energy companies in Europe but has now transitioned to become a leading renewable energy company. This year, it ranked #2 (in 2020 #1) in Corporate Knights’ index of the world’s most sustainable corporations and received a AAA rating from MSCI ESG Ratings and a B+ from ISS ESG (ranking it #1 among electric utilities)[2].

Ørsted is a longstanding green bond issuer and publishes an annual green bond report and annual sustainability report that update us on its use of proceeds from its green bonds, associated impact metrics, and any new or updated company targets[3]. For example, in 2017 Ørsted had a stated target of achieving 95% of generation from renewables by 2023. It has subsequently updated that target to carbon-neutral energy generation by 2025 and is well on its way to meeting its 2023 target with 92% of power generation from renewable sources in 2019[4].

Relying on a negative screen on Ørsted in 2017 (when it first published its green bond framework) would have been likely to conclude the company should be excluded from an impact universe. At the time it had a power generation mix of 15% coal, 13% natural gas, 51% wind and 21% biomass, therefore exceeding thresholds we commonly see for coal-based power generation[5]. However, positive selection and in-depth research would have recognised that Ørsted was committed to a low-carbon transition, had a track record of positive progress that looked set to continue, had stated targets relating to decarbonising and therefore was a good candidate for inclusion in an impact universe.

Conclusion

Negative screening is becoming increasingly common, particularly among asset owners, rating agencies and consultants, as it is an easy way to ensure that ESG values are being applied to investments.

However,

negative screening alone does not ensure that positive environmental and social

impact is delivered. To achieve this, the more nuanced, in-depth and forward

looking approach of positive selection is needed. We believe this approach

serves our clients better and delivers on our undertaking to manage fixed

income portfolios that generate positive environmental and social impact,

without compromising financial returns.

Disclaimers:

This document is being furnished on a confidential basis for discussion purposes only to a limited number of persons who may be interested in this type of investment and limited to those classified as eligible counterparties and professional clients. They are not available to retail clients. This document does not create any legally binding obligations on the part of Affirmative. Neither the information nor any opinion expressed in this document constitutes an offer, an invitation to offer, solicitation or a recommendation to enter into any transaction. The information in this document does not purport to be all inclusive or to contain all of the information that a recipient may deem material to its decision to invest. Any summaries of documents should not be relied on and references should be made to the full document. The information contained in this document is subject to change.

This document is not intended to be, nor should it be construed or used as an offer to sell, or a solicitation of any offer to buy shares or interests in any fund managed by Affirmative Investment Management Partners Limited. If any offer is made, it shall be pursuant to a definitive Confidential Private Offering Memorandum prepared by or on behalf of a specific hedge fund which contains detailed information concerning the investment terms and the risks, fees and expenses associated with an investment in that hedge fund. Neither the Financial Conduct Authority (‘FCA’) United States Securities and Exchange Commission (‘SEC’) nor any state securities administrator has approved or disapproved, passed on, or endorsed, the merits of these securities.

Nothing in this document constitutes accounting, legal, regulatory, tax, financial or other advice. Recipients should form their own assessment and take independent professional advice on the suitability and merits of investment and the legal, regulatory, tax and investment consequences and risks of doing so. Affirmative accepts no responsibility to any person for the consequences of any person placing reliance on the content of this information for any purpose.

The information contained in this document, including any data, projections and underlying assumptions, are based upon certain assumptions, management forecasts and analysis of information available as at the date hereof and reflects prevailing conditions and Affirmative’s views as of the date of the document, all of which are accordingly subject to change at any time without notice, and Affirmative is under no obligation to notify you of any of these changes. In preparing this document, Affirmative has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which has been otherwise obtained and reviewed by Affirmative in preparing this document. While the information provided herein is believed to be reliable, Affirmative makes no representation or warranty whether express or implied, and accept no responsibility for, its completeness or accuracy or reliability. Affirmative shall not be liable for any loss or damage, whether direct, indirect or consequential suffered by any person as a result of any errors in or omissions from the document (or other information) or as a result of relying on any statement contained in this document (or other information).

Past performance information contained in this document is not an indication of future performance. It has not been audited or verified by an independent party and should not be seen as any indication of returns which might be received by investors in the Fund. Similarly, where projections, forecasts, targeted or illustrative returns or related statements or expressions of opinion are given (“Forward Looking Information”) they should not be regarded by any recipient of this document as a guarantee, prediction or definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. A number of factors,

in addition to any risk factors stated in this document, could cause actual results to differ materially from those in any Forward Looking Information. There can be no assurance that the Fund’s investment strategy or objective will be achieved or that investors will receive a return of the amount invested.

Affirmative Investment Management Partners Limited

Authorised and Regulated by the Financial Conduct Authority FRN 658030, the SEC CRD Number 282138

Registered in England & Wales no. 09077671

Registered Office 55 Baker Street, London W1U 7EU

[1] Global Sustainable Investment Alliance, ‘2018 Global Sustainable Investment Review’, pg.7

[2] Ørsted, ESG ratings and reporting: https://orsted.com/en/sustainability/esg-ratings-and-reporting#esg

[3] Ørsted, Green bond investor letter 2019

[4] Ørsted Summary 2020, Annual report and sustainability report, pg.12

[5] S&P Market Intelligence Platform