What motivates investors to choose sustainable real estate and what are some of the challenges to encouraging greener buildings through investment?

In 2018, buildings accounted for 3,101 million tonnes of oil equivalent (Mtoe) [1] of final energy consumption globally; equivalent to 31% of total final energy consumption.[2] It is well understood that such a high portion of total energy consumption correspondingly means that buildings and the energy use associated are responsible for a high portion of global greenhouse gas (GHG) emissions. This, coupled with increasing urbanisation and population growth, means that if we are to transition to a low-carbon economy globally, decarbonising real estate will be essential.

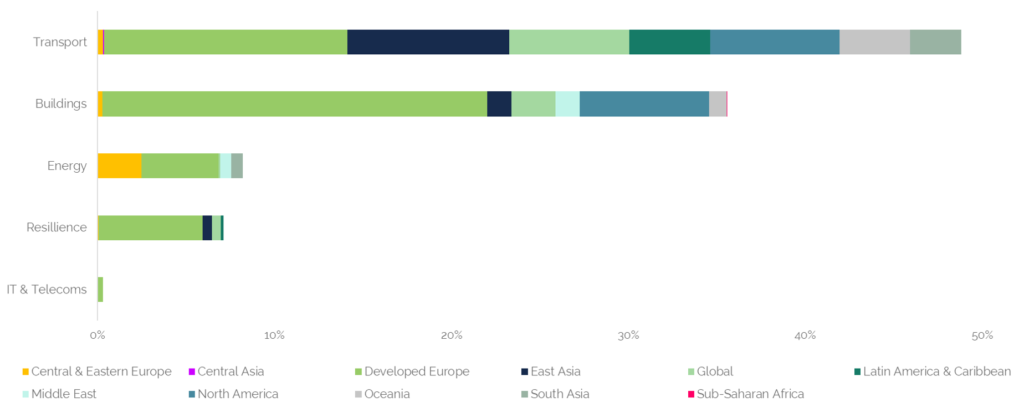

Affirmative Investment Management (AIM) is a dedicated impact fixed-income investment manager. We manage fixed-income portfolios that generate positive environmental and social impact, without compromising financial returns. We define impact as contributing to the UN Sustainable Development Goals (SDGs)[3] and/or to meeting the Paris Agreement.[4] We invest across various sectors; in our flagship fund, the Lombard Odier Global Climate Bond Fund, 56% of holdings were allocated to infrastructure-related projects, with a large portion of this going to buildings-related projects [5] see Figure 1.

Figure 1: 56% of holdings in our flagship fund, the Lombard Odier Global Climate Bond Fund, were allocated to infrastructure-related projects. A large portion of these went to buildings-related projects

Source: LO Funds – Global Climate Bond: 2019 Impact Report. Coverage ratio of 90% of 2019 portfolio holdings

‘Use of proceeds’ bonds

The bonds we invest in are largely ‘use of proceeds’ bonds, meaning that the issuers publish a framework stating assets, projects or activities that will be eligible for funding raised by the bond. Real estate, both residential and commercial, is a common use of proceeds and it is an eligible sector for AIM because of both the environmental and/or social impact it can deliver. In this article, we will focus predominantly on investing in real estate from an impact point of view.

In the labelled bond market (green, social and sustainability bonds), real estate was one of the earliest use of proceeds bonds sectors, second to renewable energy. Low carbon real estate can be included in terms of eligible use of proceeds in several ways.

Examples of how real estate is included in green, social and sustainability bonds:

- A bank may include a pool of mortgages to highly energy efficient homes

- A corporate property company may include funding to energy efficient buildings (commercial or residential)

- A company may include funding for new or refurbished headquarters, warehouses or data centres if they meet high environmental and energy efficiency standards

- A sovereign may include funding for buildings with a social purpose; for example, schools, hospitals, social housing or community buildings

A key attraction for an impact investor to choose real estate is the crucial role this sector plays in the transition to a low-carbon economy. A further attraction is that this is one sector where funded projects can have positive environmental and social impacts; positive environmental impacts come from the performance of the building – how energy efficient it is, whether it has been set-up with grey or rainwater recycling systems, what waste management solutions it has, available cyclist facilities, for example – while the positive social impacts generally come from the purpose of the building, for example, hospitals, schools and social housing.

Case study: Kommunalbanken Norway (KBN) green bond [6]

Summary of green bond framework criteria for buildings-related use of proceeds: new buildings or additions to buildings with an energy performance superior to current energy standards.

Example project: Ullerud Health Centre, Frogn Municipality, Norway

- KBN provided financing to Frogn Municipality to build the Ullerud Health Centre, the largest health centre in Norway to be constructed of mass timber.

- Environmental impacts:

- Constructed with environmentally friendly materials

- Water is heated by geothermal boreholes and waste heat from the data centre

- 1,042 MWh energy savings per year, equivalent to 328tCO2e avoided per year

- Social impacts:

- 108-bed nursing home

- Learning, activity and rehabilitation centres

- Day centre for the elderly

Key challenges

However, there are a couple of key challenges for impact investors around real estate. One of the major issues is identifying strict enough conditions on eligible use of proceeds; and the other is the growing importance of physical risk screening.

Social, green or sustainability bonds are generally backed by a framework that states the conditions that projects or assets must adhere to if they are to be eligible for financing from the bond proceeds. These conditions commonly reference buildings standards such as EPCs, BREEAM or LEED[7], or they state minimum percentage energy efficiency improvements that must be achieved. There is a plethora of green building standards used worldwide, and understanding what is equivalent to best practice versus what is really just business as usual can be challenging. At AIM, we only invest in real estate projects if they are ambitious in terms of their environmental credentials; but determining what is ambitious in the myriad standards is not always straightforward. For example, the EU Sustainable Finance Taxonomy includes mitigation thresholds for construction and real estate activities, which provide a helpful line in the sand for what constitutes best practice, but it does not yet set this threshold against commonly used green building standards.[8] We see most issuers referencing building standards in their conditions for what constitutes eligible use of proceeds. The EU Sustainable Finance Taxonomy is still relatively new, however, and we expect to see more issuers referencing eligibility that aligns with those thresholds over time.

Case study: ABN AMRO green bond[9]

Summary of green bond framework criteria for buildings related use of proceeds: mortgage loans, originated by ABN AMRO for new residential buildings that meet the criteria of the Dutch Building Decree 2012. They must have an energy performance certificate that is at least 25% lower than the current requirement for obtaining a ‘A’ in the Netherlands.

Environmental impacts:

- Supports the decarbonisation of Dutch building stock to aid the nation in meeting their broader climate goals and Nationally Determined Contribution (NDC)

- Supporting 3,844 dwellings to achieve estimated energy savings of 112kWh/m2

Source: https://www.abnamro.com/en/investor-relations/debt-investors/green-bonds/index.html

The second challenge is the inclusion of physical risk screening. While buildings have been included in labelled bonds from a social and environmental impact perspective, the majority of this has been in green bonds and the impact delivered is based on climate change mitigation – that is building features that will result in reduced CO2 emissions. Lower-emission buildings, however, are not necessarily any better equipped to cope with the coming climate changes – this is the same for infrastructure that delivers mitigation benefits in many sectors. For this reason, for the first time this year we conducted physical risk screening across our holdings at four different temperature scenarios, alongside decarbonisation consultancy South Pole.[10] This process allowed us to understand the risks that climate change poses to our current holdings. It also enabled us to have more informed engagement with issuers about what they are doing to ensure their real estate assets are well equipped to continue functioning under likely future climate changes. At present it is very rare to see issuers include comments on the climate resilience of the buildings in their portfolios or the climate scenarios analysis they may have carried out in the investor materials, but when we engage on the topic we find that many are cognisant of the risks and are building in adaptation measures. We continue to encourage issuers to be more vocal about what they are doing on the topic, particularly if they are looking to the green/sustainable finance market to raise capital.

COVID-19

COVID-19 has brought some specific challenges for investing in real estate. Individual shops and retail chains have been demanding rental freezes or payment holidays and, in the longer term, may look to increase online operations while decreasing shop floor space, and the demand for commercial office space has reduced. The long-term effects are uncertain, but some of these impacts will likely linger on. However, there is also opportunity here, particularly for green real estate. Some governments are tying recovery packages to improved climate change measures. For example, Canadian finance minister Bill Morneau announced in May that state-backed loans and financial aid will be tied to climate goals, stating that, “companies that receive this funding will be required to commit to future climate disclosures, and environmental sustainability goals”.[11] There is hope that the economic recovery from COVID-19 will provide incentives for improving the green credentials of real estate, and other infrastructure, therefore increasing the projects that can be financed under green/sustainable investing.

Katie House, Analyst, Sustainability

This article was also published by RICS and can be found on their website here.

[1] Million tonnes of Oil Equivalent

[2] IEA, World Energy Outlook 2019, table 1.2, pg.42

[3] https://www.undp.org/content/undp/en/home/sustainable-development-goals.html

[4] https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement

[5] Source: LO Funds – Global Climate Bond: 2019 Impact Report. Coverage ratio of 90% of 2019 portfolio holdings

[6] KBN case study source of information: KBN’s website, green bond page: https://www.kbn.com/en/investor/green-bonds/

[7] EPC (Energy Performance Certificate), BREEAM (Building Research Establishment Environmental Assessment Method), LEED (Leadership in Energy and Environmental Design)

[8] EU Technical Expert Group on Sustainable Finance, Taxonomy Report: Technical Annex, March 2020, pg. 367-390

[9] ABN AMRO case study source of information: ABN AMRO website: green bond webpage: https://www.abnamro.com/en/investor-relations/debt-investors/green-bonds/index.html

[10] In 2020, AIM contracted South Pole to complete a physical risk screening across our 2019 holdings where data availability allowed the screening to be completed

[11] Canada ties coronavirus help to climate goals. Available at: https://www.macaubusiness.com/canada-ties-coronavirus-help-to-climate-goals/