SFDR: sustainability-related disclosures

These disclosures relate to the following three funds:

LO Funds – Global Climate Bond (A sub-fund of Lombard Odier Funds, an investment company with variable capital (“SICAV”) incorporated in Luxembourg.)

Legal entity identifier: 54930036D61FAKVELK03

AIM ESG Impact Global Bond Fund (A sub-fund of Skyline Umbrella Fund ICAV, an Irish collective asset-management vehicle established as an umbrella fund with segregated liability between sub-funds pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations 2011, as amended from time to time. This Sub-Fund is managed by IQEQ.)

Legal entity identifier: 635400ALJWXNAVYDWV79

AIM US$ Liquid Impact Fund (A sub-fund of Skyline Umbrella Fund ICAV, an Irish collective asset-management vehicle established as an umbrella fund with segregated liability between sub-funds pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations 2011, as amended from time to time. This Sub-Fund is managed by IQEQ.)

AIM US$ Liquid Impact Fund has no current investments.

Legal entity identifier: 635400J8EW3R6FEEVE68

(Each a “Fund” and together the “Funds”)

Summary

The Funds have sustainable investment objectives in accordance with Article 9 of Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector (the “Disclosures Regulation” or “SFDR”).

The Funds are dedicated impact fixed income funds and have sustainable investment as their core objective. The Funds seek to provide mainstream, risk-adjusted returns alongside positive and verifiable environmental and social impact. Securities are only held in the Funds if they have a positive environmental and/or social impact that contributes either to meeting the Paris Agreement or the UN Sustainable Development Goals.

At AIM, we use our proprietary and independent verification process, the SPECTRUM process, to ensure investments within our investable universe have positive environmental and/or social impact and sustainable objectives while also not causing any significant harm to any environmental or social objective. The SPECTRUM process is primarily one of positive selection and defines our investable universe, the SPECTRUM Bond® universe. Both the issuer of the securities and the securities must pass our SPECTRUM process from an environmental, social and governance perspective.

As part of our SFDR disclosures, we commit that for these Funds at least 75% will be held in investments with an environmental objective. The remaining holdings, excluding cash, will be held in investments with an environmental, social or sustainable (environmental and social) objective.

Therefore, all of the Funds, excluding cash, are held in investments with a sustainable (environmental and/or social) objective.

Monitoring of the sustainable investment objective is achieved through our annual Impact Reporting. We report on the environmental and social impact of each Fund in individual portfolio-specific Impact Reports. Engagement is a key tool that we use in both our impact reporting cycle and our SPECTRUM verification process. The process and data sources used for our impact reporting are described below. Impact reporting is a crucial part of evidencing the attainment of the Funds’ sustainable investment objective.

Our other SFDR disclosures can be found in the following locations:

Precontractual disclosures:

- LO Funds – Global Climate Bond: Fund Supplement available at: https://am.lombardodier.com/ch/en/private/investment-funds/fund/41043.html

- AIM ESG Impact Global Bond Fund: Fund Supplement and ICAV Prospectus, available at https://iqeq.com/skyline

- AIM US$ Liquid Impact Fund: Fund Supplement and ICAV Prospectus, available at https://iqeq.com/skyline

Annual statement on principal adverse impacts of investment decisions on sustainability factors:

- The first statements on PAIs will be published on this webpage by 30 June 2023. We will publish one statement per fund.

No significant harm to the sustainable investment objective

The Funds are dedicated impact fixed income funds and have sustainable investment as their core objective. We use our proprietary and independent verification process, the SPECTRUM process, to ensure investments within our investable universe both deliver positive environmental or social impact and do not cause significant harm to any environmental or social objective. Our verification process is primarily one of positive selection and defines our investable universe, the SPECTRUM Bond® universe. Further details are available here.

If an investment is associated with significant environmental or social harm it would fail to meet the SPECTRUM Bond® criteria and would be excluded from the SPECTRUM Bond® universe. As a result, the issuance will not be eligible for purchase. The SPECTRUM® process requires the analyst to consider whether there are direct or indirect environmental or social negative impacts resulting from the stated use of proceeds or the issuer.

We also adhere to our exclusionary policy available here.

We consider the principal adverse impacts (PAIs) and ensure that the sustainable investments are aligned with the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights. More information about our approach to the PAIs is available here:

- Assessment of PAIs

- Statement on principal adverse impacts of investment decisions on sustainability factors – the first statements on PAIs will be published on this webpage by 30 June 2023. We will publish one statement per fund.

Sustainable investment objective of the financial product

We are a dedicated impact fixed income manager that has sustainable investment as our core objective. Securities are included in our investable universe if they have a positive environmental and/or social impact that contributes either to meeting the Paris Agreement or the UN Sustainable Development Goals. The issuer of securities must also pass our verification process from an environmental, social and governance perspective. We seek to provide mainstream, risk-adjusted returns alongside positive and verifiable environmental and/or social impact.

The UN Sustainable Development Goals are a collection of 17 interlinked global goals designed to achieve a better and more sustainable future for all. The 17 goals are: (1) No Poverty, (2) Zero Hunger, (3) Good Health and Well-being, (4) Quality Education, (5) Gender Equality, (6) Clean Water and Sanitation, (7) Affordable and Clean Energy, (8) Decent Work and Economic Growth, (9) Industry, Innovation and Infrastructure, (10) Reducing Inequality, (11) Sustainable Cities and Communities, (12) Responsible Consumption and Production, (13) Climate Action, (14) Life Below Water, (15) Life On Land, (16) Peace, Justice, and Strong Institutions, and (17) Partnerships for the goals. Each goal has a specific target to be achieved between 2020 and 2030. The Paris Agreement’s goal is to avoid dangerous climate change by limiting global warming to well below 2°C and pursuing efforts to limit it to 1.5°C. It also aims to strengthen countries’ ability to deal with the impacts of climate change and support them in their efforts.

Investment strategy

An investment strategy is what guides the decision on what to invest in based on e.g. investment goals, risk tolerance and future needs for liquidity. The investment objective and strategy of each Fund is described in the Fund’s Supplement.

For all our funds, we invest in securities which are verified as having a positive environmental and/or social impact and which contribute to achieving the UN Sustainable Development Goals and/or the Paris Agreement. Our verification team, which comprises the credit and sustainability teams, analyses each security and issuer according to the SPECTRUM® process. The output of this analysis is the investable universe from which our portfolio management team manages the Funds. The impact of the Funds are measured on an annual basis in the annual Impact Report.

Binding elements of the investment strategy are that the Funds invest only in securities that are expected to deliver a positive environmental and/or social impact. The investment universe is limited to securities which have passed the AIM proprietary SPECTRUM® verification process, which includes separate sustainability and credit assessments.

The exclusion of certain issuers is another binding element. Issuers that are involved in certain sectors or are poor ESG performers, as set out in our exclusionary criteria, will be excluded from the portfolio. Such issuers are examined on a case-by-case basis under the SPECTRUM® process. Our exclusionary criteria apply to the Funds, details of which can be found here.

We undertake our verification assessment at both the issue and issuer level. Our issuer level assessment includes E, S and G considerations. A key consideration is therefore the governance practices of issuers, including a company’s leadership, remuneration of staff (incl. executives}, audits, internal controls, shareholder rights, tax compliance and its relations to other stakeholders. Both the sustainability and credit teams consider an issuer’s governance in their assessments. Governance is specifically taken into account under the ‘ethics & issuer conduct’ (credit assessment) and ‘responsible issuer’ (sustainability assessment) pillars.

Proportion of investments

Our funds and portfolios are managed from the SPECTRUM Bond® universe. All securities within the universe have met our criteria from a sustainability and credit perspective and have a positive environmental and/or social impact. This means that all holdings, except cash, have a sustainable investment objective. Our holdings have a mixture of environmental objectives, social objectives and dual environmental and social objective, which we classify as sustainable objective. We commit that these Funds will have a minimum of 75% of investments with an environmental objective. The remaining investments, except cash, will have either environmental, social or sustainable objective, but exact portfolio weights to each will fluctuate depending on the market.

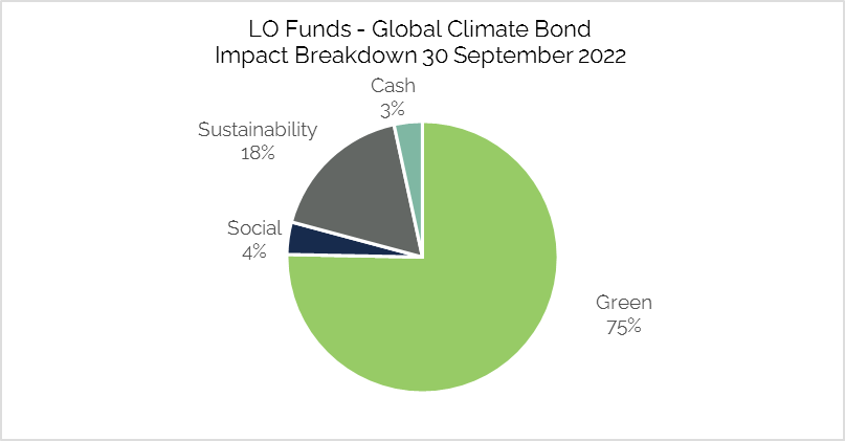

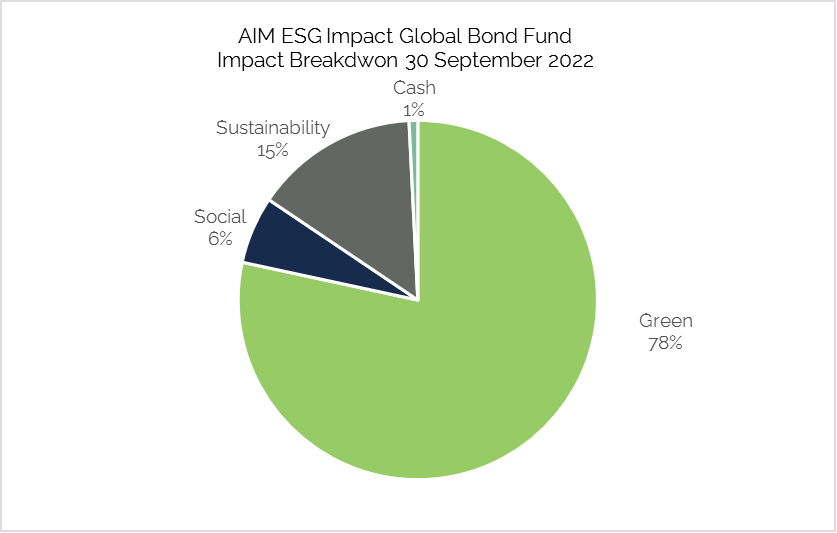

As an example, we present the portfolio weights as at 30 September 2022:

Source: AIM, Bloomberg, Northern Trust

AIM US$ Liquid Impact Fund has no current investments.

Monitoring of sustainable investment objective

Monitoring and reporting of the sustainable investment objective is completed through our annual impact reporting process. Our annual Impact Reports are available here.

Methodologies

All methodologies employed to monitor and measure the attainment of the sustainable investment objective and the sustainability indicators are described in our annual Impact Reports, available here.

Data sources and processing

Data sources and processing is a mixture of in-house data collection and calculation and use of third-party data and methodologies. This is described in the methodology section of our annual Impact Reports, available here.

Limitations to methodologies and data

We do all that we can to minimise the limitations of methodologies and data. Data products to measure and monitor the use of proceeds of green, social and sustainability bonds – the main data set we need to be able to monitor the achievement of our sustainable investment objective – are extremely limited in terms of their coverage of the market and/or the granularity of the dataset. For this reason we collect data on the use of proceeds of the bonds held in-house. This is a resource intensive exercise, but it yields a very high coverage of the bonds we hold giving us confidence that the sustainable investment objective is being achieved. For example, our 2022 impact reporting achieved coverage of 95% across all holdings.

One limitation is that we rely on the data issuers provide in their labelled impact bond reports. Within our impact reporting process, we do screen the data provided for anomalous data points and engage with issuers if the reporting is unclear or incomplete.

Many issuers report their own metrics for avoided emissions, which is one of our key impact metrics. To ensure consistency, we run a methodology in partnership with ISS ESG to separately calculate the avoided emissions of the projects supported. This methodology is described in our annual Impact Reports available here.

We undertake this exercise to standardise our reported metrics as there are multiple methodologies with underlying assumptions that can be used to calculate avoided emissions.

Due diligence

Due diligence is conducted through the SPECTRUM verification and annual impact reporting processes. Details of both are provided above.

Engagement policies

Our engagement policy is included within out Responsible Investment Policy, which is available here.

We report annually on our engagement activity in our Impact Reports, which are available here.

Attainment of the sustainable investment objective

We invest in securities which are verified as having a positive environmental and/or social impact and which contribute to achieving the UN Sustainable Development Goals and/or the Paris Agreement. We seek to deliver risk-adjusted mainstream returns with environmental and/or social impact. We manage against mainstream benchmarks, as specified by our clients. The index is not used to measure sustainability performance.

No index has been designated as a reference benchmark to meet the Fund’s sustainable investment objective.

Remuneration policy

As a specialist impact fixed income manager, sustainability is integral to all that we do. Our approach to sustainability risk and considerations is integrated to our overall strategy and therefore a core consideration within remuneration assessments.

Updated: 23 December 2022