Recent storms and floods in the Indian subcontinent, China, Caribbean and the US show the devastating impact natural catastrophes can have on humans and the economy. The flooding in South Asia has killed more than 1,000 people,[ii] and the combined losses of Hurricanes Harvey and Irma are being estimated around $290 billion.[iii] As of this writing, estimated losses from Hurricane Maria, which has again decimated Puerto Rico and parts of the Caribbean, are yet to be calculated. Given that extreme weather events are expected to become more frequent and ferocious with global warming, we must begin to adapt and build for resilience.

Climate change mitigation projects, being actions that are designed to reduce greenhouse gas emissions, have dominated green bond market issuance. But mitigation efforts are not enough. Estimated projections for population and the carbon intensity of economic growth make it increasingly clear that we may be locked into at least a 2.0°C warming scenario.[iv] It is crucial that we turn more of our attention to helping our communities cope with and prepare for the changes, i.e. adapt to the changes that are coming. Examples of adaptive strategies include constructing seawalls against rising sea levels, building more artificial water storage capacity to deal with less frequent rainfall, and developing more climate resilient agricultural seeds to combat high temperatures.

Adaptation to climate change is critically underfunded

Adaptation remains critically underfunded. UNEP reports that $22.5 billion was spent on adaptation by developing countries in 2014.[v] The Paris Agreement seeks $100 billion per annum for both adaptation and mitigation. Assuming that pledge is met and even half of this is spent on adaptation ($50 billion), the adaptation financing gap is still huge. According to UNEP, by 2030 the projected costs of adaptation are $300 billion per year, but that gap is certain to grow, unless we are able to secure new and additional finance. It is time for the private sector to pick up the slack.

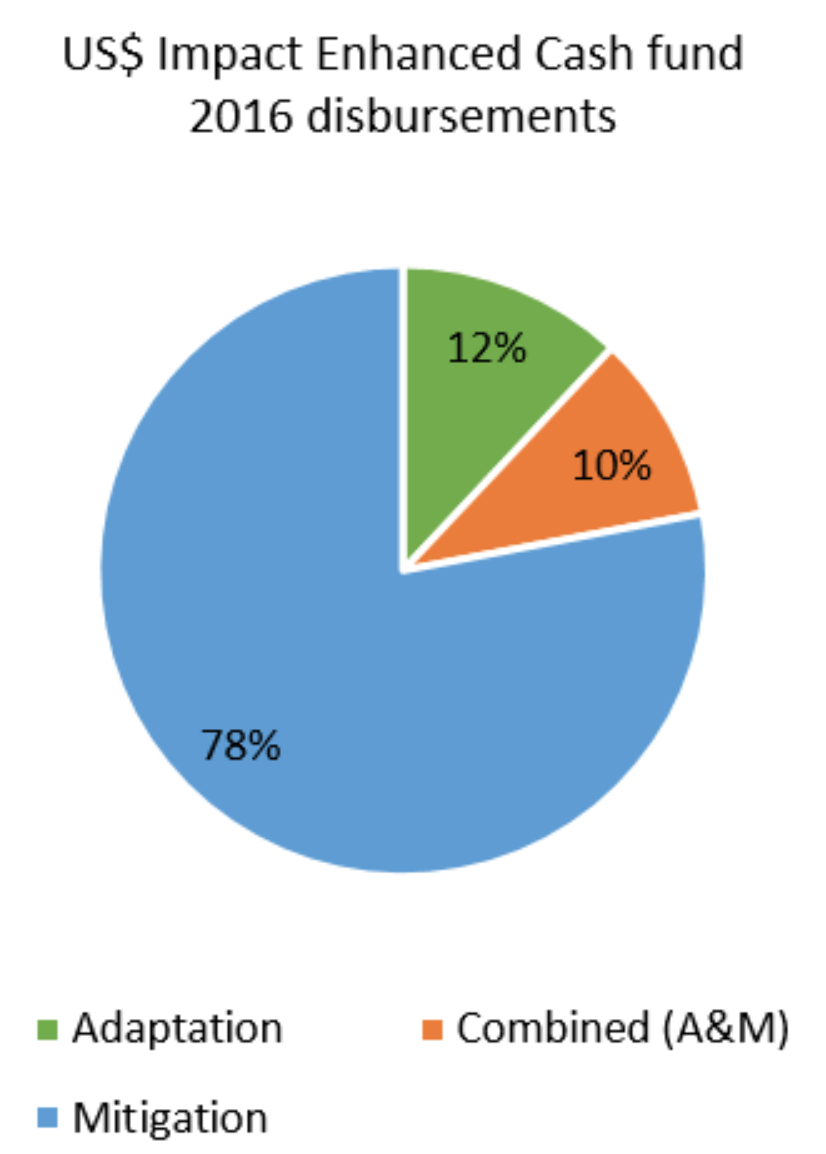

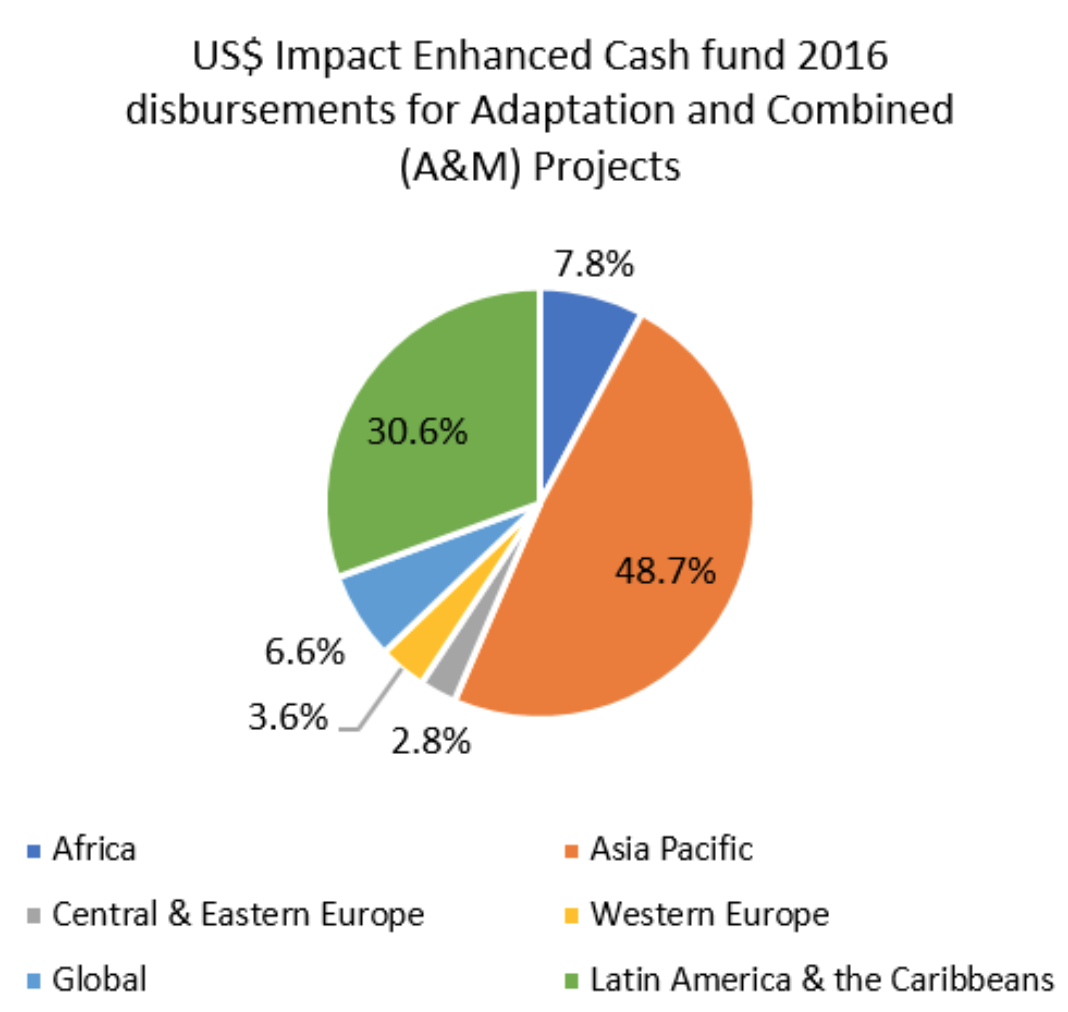

There is little research as to exactly how much the green bond market has contributed to funding adaptation. The Climate Bonds Initiative estimated[vi] that direct adaptation received 7% of green bond funding and combined mitigation and adaptation projects 13% in 2016. Based on our 2016 average holdings in the US$ Impact Enhanced Cash fund (the impact report was published on 27th June 2017), direct adaptation projects received 12% of the proceeds and combined mitigation and adaptation projects an additional 10%. To date in the green bond market mitigation has rightly received the lion’s share of funding, but there is a burgeoning opportunity to finance adaptation projects.

Distinguishing the climate vulnerable regions

The effects of climate change are being felt around the globe, but the impacts are distributed unevenly. Countries are exposed to different levels of climate risk, and have an uneven ability to deal with it.[vii] Certain regions and countries are particularly exposed to rising sea levels, changing rainfall patterns, or extreme temperatures. Countries that lack the capacity to adapt to these risks are climate vulnerable. The ability to adapt, however, is closely linked to a country’s economic capacity – the Netherlands, for example, is highly vulnerable to rising sea levels, but they have the resources to build infrastructure to protect against flooding. Lower income regions, where the climate shocks will also be the harshest, have less economic and institutional capability to adapt to changing conditions. For example, in Ethiopia, where rainfall variability is high and the country has critically inadequate water storage capacity,[viii] adaptation must include an array of interventions, including water storage, watershed management, farming practices, early warning systems, disaster relief intervention capabilities, and more.

Mitigation can be a form of early adaptation

Climate change interventions are typically viewed as mitigation or adaptation, but sometimes the difference between the two is not clear-cut. Mitigation projects seek to curb current and future greenhouse gas emissions to prevent further global warming, whereas adaptation strategies help communities adjust and adapt to a changing climate. Yet, the two are interlinked, whereby various mitigation strategies may also form an adaptation strategy.

Rooftop solar systems, for example, are typically considered mitigation projects because they increase the supply of renewable, carbon-free electricity, but such systems could also help societies adapt to fluctuating climate conditions. During a disaster, a centralised power source can be lost, but households and businesses with rooftop solar systems both retain their own power, and may also contribute non-centralised electric power to the region if they are grid-connected and the system is designed to receive it.

Commitment to tracking the impacts of our mitigation and adaptation investments

As a dedicated impact fixed income fund manager, through our verification process we identify those issuances whose proceeds go toward the sectors, geographies, and environmental, social, and economic contexts that most likely will have positive and demonstrable impacts. We prioritise funding for key sectors, such as water, biodiversity and land management, which integrates our in-house sector research with country vulnerability data. We classify our investments carefully as adaptation, mitigation, or a mix of both. This information is shared annually along with various qualitative and quantitative metrics with our investors. Adaptation reporting remains challenging, however, and we are collaborating with partner organisations to strengthen adaptation-focussed reporting tools.

Project Example 1: IBRD Green Bond Portfolio Project– Guangdong Agricultural Pollution Control

The project curbs emissions and pollution from livestock and crop production through waste management. This entails methane capture and use, utilisation of biogas, improving soil nutrients, fertiliser and pesticide use. We have classified the project having a mix of mitigation and adaptation. First, the project curbs methane release, which is a highly potent greenhouse gas. Second, by reducing waterway pollution and improving the health of existing ecosystems, resilience to water and temperature stresses is enhanced.

Project Example 2: NWB Green “Water” Bond Project – Flood Protection at Katwijk

The coastal municipality of Katwijk is next to some of the most densely populated areas of the Netherlands. Flood protection on the coast was found to be below par by a Dutch Water Board. The project entails strengthening the coastline with a dyke embedded in broader dunes, including creating space for an underground parking garage. Flood risks in the province of South Holland near cities such as Leiden and The Hague are potentially devastating given population concentration. We consider this project as an exemplary case of climate change adaptation in a climate vulnerable location.

Conclusion

Adaptation related projects are receiving more attention in the green bonds space. We believe this is a real opportunity to help develop, support and facilitate more adaptation initiatives within green bond structures. Climate change is happening, and there is an immediate need to help support the communities and ecosystems most vulnerable. Some development banks and organisations (such as the World Bank and UNDP) posit, ‘development is contingent on adaptation’,[ix] whereby some adaptation measures must be in place to manage sustainable (economic) development in the future. In other words, good development is development that has integrated adaptation in its core planning.

To support this planning, we allocate considerable time and resources to analyse the projects supporting climate adaptation initiatives. Albeit mitigation considerations continue to receive the lion’s share of attention within green bond funding, we believe it is just as imperative that adaptation financing grows in parallel.